SAS’ RESTRUCTURING PROCEEDINGS IN THE U.S. AND SWEDEN

SAS is taking steps as part of SAS FORWARD, its comprehensive business transformation plan that was launched to enable the company to continue to be a competitive player in the global airline industry.

THE CHAPTER 11 PROCESS IN THE U.S.

On July 5, 2022, SAS announced that the company had voluntarily filed for chapter 11 in the US. The chapter 11 process is a legal process conducted under the supervision of the U.S. federal court system, which many large international airlines based outside of the U.S. have successfully used over the years to reduce their costs and complete financial restructurings. The aim of the chapter 11 process was to reach agreements with key stakeholders, restructure the company’s debt obligations, reconfigure its aircraft fleet, and emerge with a significant capital injection.

On March 19, 2024, SAS received confirmation from the US Bankruptcy Court for the Southern District of New York for its chapter 11 plan of reorganization. The effectiveness of the chapter 11 plan remains subject to various conditions precedent, including approvals from various regulatory authorities and the completion of a company reorganization of SAS AB in Sweden.

COMPANY REORGANIZATION OF SAS AB IN SWEDEN

On March 27, 2024, SAS AB applied for company reorganization in Sweden. The application was made only in relation to the listed parent company of the SAS Group, SAS AB, and not any subsidiaries or the airline as such. SAS’ operations and flight schedule will remain unaffected by the reorganization proceeding and SAS will continue to serve its customers in the ordinary course throughout this process.

On June 10, 2024, SAS AB announced the plan of reorganization in its company reorganization proceeding in Sweden, which includes, inter alia, a description of the debt settlement proposal and certain proposed corporate resolutions.

On July 12, 2024, the plan hearing, during which affected parties had the opportunity to vote on the plan of reorganization, took place in the Stockholm District Court.

On July 19, 2024, the Stockholm District Court approved the plan of reorganization. As a result, SAS AB’s existing common shares and listed commercial hybrid bonds will be redeemed and cancelled in connection with SAS’ emergence from its restructuring proceedings. SAS AB applied for the delisting of its existing common shares from Nasdaq Stockholm, Nasdaq Copenhagen and Oslo Børs and for the delisting of the SAS AB’s listed commercial hybrid bonds from Nasdaq Stockholm, conditional upon the decision to approve the reorganization plan entering into legal force.

Delisting and emergence from restructuring proceedings

August 13, 2024, was the last day of trading in SAS AB’s existing common shares on Nasdaq Stockholm, Nasdaq Copenhagen and Oslo Børs, and the last day of trading in its listed commercial hybrid bonds on Nasdaq Stockholm.

On August 28, 2024, SAS announced that the company had completed its restructuring proceedings and emerged from Chapter 11 in the US and from the company reorganization in Sweden. The new principal owners of the reorganized company are Castlelake, Air France-KLM, Lind Invest and the Danish State. In connection with emergence, all SAS AB’s common shares were redeemed and cancelled.

- Plan of reorganization in SAS AB’s company reorganization

- Appendix 1 - Administrator's report

- Appendix 1.1 to the Administrator's report - SAS Annual and sustainability report FY2023

- Appendix 1.2 to the Administrator's report - Inventory of assets and liabilities SAS AB

- Appendix 2 - Definitions

- Appendix 3 - Proposal for resolution on cash issue

- Appendix 4 - Proposal for resolution on DIP Issue

- Appendix 5 - Proposal for resolution on set-off issue

- Appendix 6 - Proposal for resolution on in-kind issue

- Appendix 7 - Proposal for resolution on amendment of the articles of association

- Appendix 8 - Proposal for resolution on reduction of the share capital

- Appendix 9 - Proposal for resolution on bonus issue

- Appendix 10A.1 - Board statement pursuant to Ch 12, Sec 7 and Ch 13, Sec 6 of the Swedish Companies Act

- Appendix 10A.2 - Auditor's statement pursuant to Ch 12, Sec 7 and Ch 13, Sec 6 of the Swedish Companies Act

- Appendix 10B.1 - Board statement pursuant to Ch 13, Sec 7 of the Swedish Companies Act (DIP issue)

- Appendix 10B.2 - Auditor's statement pursuant to Ch 13, Sec 8 of the Swedish Companies Act (DIP issue)

- Appendix 10C.1 - Board statement pursuant to Ch 13, Sec 7 of the Swedish Companies Act (set-off issue)

- Appendix 10C.2 - Auditor's statement pursuant to Ch 13, Sec 8 of the Swedish Companies Act (set-off issue)

- Appendix 10D.1 - Board statement pursuan to Ch 13, Sec 7 of the Swedish Companies Act (in-kind issue)

- Appendix 10D.2 - Auditor's statement pursuant to Ch 13, Sec 8 of the Swedish Companies Act (in-kind issue)

- Appendix 10E.1 - Board statement pursuant to Ch 20, Sec 13 of the Swedish Companies Act

- Appendix 10E.2 - Auditor's statement pursuant to Ch 20, Sec 14 of the Swedish Companies Act

- Appendix 11 - Recipient Shareholders' Agreement

- Appendix 12 - Plan Supplement in connection with Chapter 11 Plan (CVN-related documentation)

- Appendix 13 - Summary of the CVN Structure

- Appendix 14 - Affected parties and grouping

- Appendix 15 - CVN Registration Form

DISTRIBUTIONS TO GENERAL UNSECURED CREDITORS

The recovery to general unsecured creditors under the chapter 11 plan and SAS AB’s plan of reorganization in Sweden (as applicable) will be distributed in cash and/or new unlisted shares in SAS AB, as well as through contingent value notes (CVNs) that may, under certain conditions, entitle such general unsecured creditors to an additional cash distribution in the future. As to the SAS AB’s listed commercial hybrid bonds, holders of such commercial hybrid bonds as of Friday, July 26, 2024 will be entitled to receive a distribution under the Reorganization Plan.

In order to receive new shares and/or CVNs in connection with SAS’ emergence from its restructuring proceedings, general unsecured creditors entitled to such instruments must complete and submit certain registration form(s). The registration forms, which include further information and relevant deadlines, are available below and on a separate website administered by SAS’ claims agent, Kroll Restructuring Administration LLC, at https://cases.ra.kroll.com/SAS. Please note that failure to provide the requested documentation in a timely manner may result in all right, title and interest to such new shares and/or CVNs (as applicable) that you would otherwise be entitled to being forfeited.

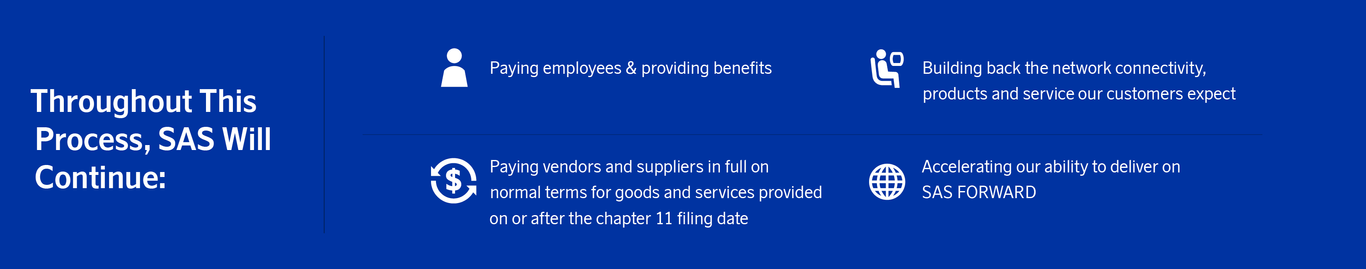

Operating As Usual

SAS’ operations and flight schedule will remain unaffected by the restructuring proceedings and SAS will continue to serve its customers in the ordinary course throughout this process.

For Customers:

- Your current bookings remain in effect and you will be notified as usual if there are any changes to our scheduled departures.

- You can continue to book flights online at flySAS.com or through SAS’ mobile app without service disruption. Reservations and all other customer services and systems will continue as they have been.

- You can continue using tickets, vouchers and gift cards purchased before SAS initiated this process.

- We will honor all EuroBonus services and benefits, and you will be able to continue accruing and redeeming points earned through EuroBonus to purchase tickets with SAS during this process.

- We will continue to issue ticket refunds and honor travel coupons and payments or credits associated with baggage or service claims in adherence with our current policies

For Employees:

- You will continue receiving pay and benefits as normal.

- The restructuring proceedings have no impact on your day-to-day responsibilities.

Press releases

- SAS initiates court-supervised process in the United States by a Chapter 11 filing to implement key elements of SAS FORWARD Plan and will continue to serve its customers throughout the process

- SAS receives all court approvals necessary to continue operating its business

- SAS files Statements of Financial Affairs (SOFA) and Schedules of Assets and Liabilities (SOAL) with U.S. Court and announces certain financial information for the Group

- SAS Secures USD 700 Million in Debtor-in-Possession Financing

- SAS Receives Court Approval for USD 700 Million in Debtor-in- Possession Financing

- SAS Announces Further Details on the SAS FORWARD Plan including a Financial Outlook

- SAS Reaches Agreements to Amend the Terms of Existing Aircraft and Equipment Lease Agreements

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS Reaches Agreements with Additional Lessors to Amend the Terms of Existing Aircraft and Equipment Lease Agreements

- SAS Reaches Agreement with Additional Lessor to Amend the Terms of Existing Aircraft and Equipment Lease Agreements

- SAS Receives Court Approval for Collective Bargaining Agreements with SAS Scandinavia Pilots’ Unions

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS gives notice of non-payment of interest on Swiss bonds as part of the ongoing chapter 11 process

- SAS Reaches Agreements with Two Additional Lessors – Concludes Lessor Negotiations as Part of Its Chapter 11 Process

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS initiates process to raise equity financing, provides updated financial projections and confirms expectations for existing shareholders and creditors

- SAS defers interest payment on perpetual capital securities as part of the SAS FORWARD plan and the ongoing chapter 11 process

- Update on SAS’ debtor-in-possession term loan

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS Receives Court Approval for Equity Solicitation Procedures

- Update on Timeline for SAS Equity Solicitation Process

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- Update on Timeline for SAS Equity Solicitation Process

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS’ evaluation process ongoing following expiration of final bid deadline

- Invitation to press conference for status update on SAS’ equity solicitation process

- SAS reaches major milestone in SAS FORWARD – announces the winning consortium, including details of the transaction structure

- SAS defers interest payment on perpetual capital securities as part of the SAS FORWARD plan and the ongoing chapter 11 process

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS enters into investment agreement and replacement facility for existing debtor-in-possession financing

- SAS receives court approval to enter into investment agreement in its exit financing solicitation process

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS provides update on chapter 11 process, including financial projections

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS provides update on expected recoveries for creditors in the chapter 11 process – obtains support of Official Committee of Unsecured Creditors

- SAS receives court approval of chapter 11 plan

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS AB applies for company reorganization in Sweden – operations continue as normal

- SAS defers interest payment on perpetual capital securities as part of the ongoing chapter 11 process, and the ongoing company reorganization proceeding in Sweden

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- Plan of reorganization in SAS AB’s company reorganization announced

- Date for plan hearing in SAS AB’s company reorganization announced

- SAS AB’s plan of reorganization in Sweden approved – applies for a conditional delisting of all common shares and commercial hybrid bonds

- SAS files monthly operating reports with U.S. court and announces certain financial information for the Group

- SAS announces last day of trading in its common shares and commercial hybrids bonds, and confirms previously announced record date

- SAS enters a new era as Scandinavia’s leading airline following successful emergence from restructuring proceedings

- SAS announces designated Board of Directors

INFORMATION REGARDING SAS’ US CHAPTER 11 CASES AND SAS AB’S COMPANY REORGANIZATION IN SWEDEN

US court filings and other documents related to the chapter 11 cases in the US are available on a separate website administered by SAS’ claims agent, Kroll Restructuring Administration LLC, at https://cases.ra.kroll.com/SAS. Information is also available by calling (844) 242-7491 (U.S./Canada) or +1 (347) 338-6450 (International), as well as by email at [email protected]. Swedish court filings related to SAS AB’s company reorganization in Sweden can be requested from the Stockholm District Court, and certain documentation is also provided by the administrator on a separate website administered by Ackordscentralen (AC-Gruppen AB), https://ackordscentralen.se/en/reorganisations/sas-ab/.

Contact information

Media:

SAS Press Office

+46 8 797 2944